December 2021 is a Seller's market!

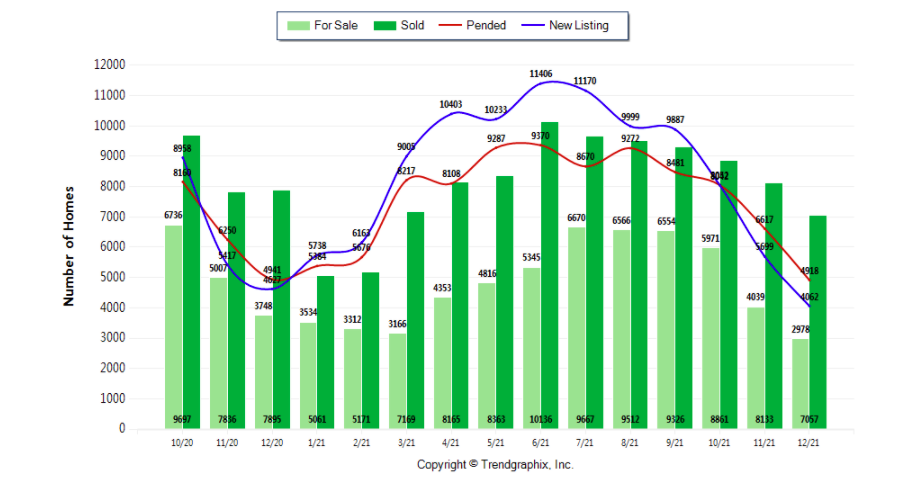

The number of for sale listings was down 20.5% from one year earlier and down 26.3% from the previous month. The number of sold listings decreased 10.6% year over year and decreased 13.2% month over month. The number of under contract listings was down 25.7% compared toprevious month and down 0.5% compared to previous year. The Months of Inventory based on Closed Sales is 0.4, down 21.1% from the previous year.

The Average Sold Price per Square Footage was up 0.8% compared to previous month and up 19.8% compared to last year. The Median Sold Price increased by 0.8% from last month. The Average Sold Price also increased by 1.7% from last month. Based on the 6 month trend, the Average Sold Price trend is "Neutral" and the Median Sold Price trend is "Neutral".

The Average Days on Market showed a upward trend, a decrease of 19.2% compared to previous year. The ratio of Sold Price vs. Original List Price is 102%, an increase of 2% compared to previous year.

It is a Seller's Market

Property Sales (Sold)

December property sales were 7057, down 10.6% from 7895 in December of 2020 and 13.2% lower than the 8133 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 770 units of 20.5%. This year's smaller inventory means that buyers who waited to buy may have smaller selection to choose from. The number of currentinventory is down 26.3% compared to the previous month.

Property Under Contract (Pended)

There was a decrease of 25.7% in the pended properties in December, with 4918 properties versus 6617 last month. This month's pended property sales were 0.5% lower than at this time last year.

Be prepared for 2022 and how best to navigate the real estate market. Top 3 Real Estate Market Trends 1) Mortgage rates are going up this year. 2) More Buyers (higher prices). 3) Inventories Remains Low (low competition).

There are all kinds of loans that allow for lower credit scores but when you get into some of the jumbo categories, they really start looking at Tradelines. You can have a really good credit score - 700, 750, 800 but if you only have two(2) tradelines it might preclude you from qualifying for certain jumbo lending. What is a Jumbo Loan? Jumbo Loan is a category above the conforming limit. The conforming limit is 648 but it's county-specific. King County, Snohomish County, and Pierce County - have what is called "High Balance" and that goes to 891. Debit Card is NOT going to be a Tradeline. You need to have at least 12 to 24 months of history on either of your credit cards, car loan, mortgage, gas card that is based on credit, store card like Home Depot or Nordstrom in order for those to be considered as Tradeline. Your interest rate is based on risk. The more you can prove that you can pay back your debt the better your credit score is going to be. Do not max your credit card. Keep 30% of the credit card limit at all times. Pre-Qualification, just to let everybody know - that is just you could literally just pick up the phone and talk to somebody, give them some basic information and they will give you a Pre-Qualification. Now a Pre-Approval, means that they have vetted more of your information. They have gotten your down payment or they've proved or they have seen proof of funds. They have gotten your Verification of Employment or a V. O. E...You know they've looked at your bank statement. Seen and looked at your tax returns hopefully. Prepaids are your deposits for taxes and insurance for the 1st year. It's calculated depending on when you close but essentially, they want to see 6 months of property taxes based on the property you're buying and a year's worth of insurance. Reserves is the amount that is usually representative of a certain number of months of your full mortgage payment. Lenders don't collect it, they just need to see it. Getting pre-approved is the number 1 recommendation for those struggling to buy a home in these multiple offer situations.

Severe shortages of inventory, record-low temperatures and snow restrained December housing activity around Washington state beyond expected seasonal slowdowns, according to a new report from Northwest Multiple Listing Service. Summary statistics from the MLS show the volume of new listings added area-wide dropped 12.3% during December compared with the same month a year earlier. Year-over-year inventory, pending sales, and closed sales all fell by double digits. Only prices rose - up 17.4% overall for homes and condominiums that sold across the 26 counties in the report.

The median price for last month's closed sales was $572,900, up from twelve months ago when it was $488,000. Prices for single family homes (excluding condos) surged nearly 17.5%, from $502,247 to $590,000. King County was one of only three counties where the single family price change was under 10%; prices there rose from $740,000 to $810,000. A dozen counties had price jumps of 20% or more. Condo prices jumped 17.6%, from $370,000 to $435,000. San Juan County reported the highest median price for last month's condo sales ($642,500), followed by Snohomish County ($500,000). Northwest MLS brokers reported 8,017 closed sales last month, a drop of nearly 1,000 transactions from the year-ago total of 9,008. Eleven counties had double-digit declines, including King (down 16.3%) and Snohomish (down 17.6%). October was the only other month during 2021 when year-over-year sales fell.

Slowdown in sales is to be expected considering inventory in the fourth quarter was down sharply from last year. You can't sell what isn't there. Despite hurdles (including pandemic-related), Northwest MLS brokers tallied 107,354 closed sales during 2021, an increase 12.1% from the previous year when they notched 95,760 closings.

Median home prices in 2021 tended to rise each month in most counties served by NWMLS, "but December came in flat," which signals a leveling off in appreciation while demand is still high. The Fed (Federal Reserve System) signaling interest rate increases has caused some sellers to be somewhat more aggressive in getting their homes sold. Condos continue to be swarmed by first-time buyers. We aren't seeing as many relocation buyers, a result of remote work during COVID. As companies start to make decisions about working in the office, we will start to see that market pick up.

Even though the number of pending sales, at 5,850 overall, declined more than 15% from a year ago, they far outstripped the number of new listings (4,617), contributing to the meager month end inventory. In fact, a search of NWMLS records going back a decade indicates the 3,240 active listings of homes and condos area-wide is the first time the selection has dipped below 4,000 listings. A year ago, buyers could choose from 4,739 active listings while in November there were 4,621 properties in the MLS database. Stated another way, there was less than two weeks of supply (0.40) at month end. Inventory was even more sparse in seven counties, with Snohomish having the most acute shortage at 0.20 months. Other counties that fell below 0.40 months were Clark (0.26), King (0.27), Island (0.29), Pierce (0.32), Thurston (0.31) and Kitsap (0.38). Smart buyers are making their best offers using pre-inspections, family support, bridge loans, leveraging 401(k) accounts, and other resources. Mortgage interest rates are the wild card

2021 was quite a year for the housing market. Even in the face of historically low inventory levels, home sales in the Central Puget Sound area still managed to rise to levels not seen since 2006 and, notably, Pierce and Kitsap counties had more sales than ever before. Historically low mortgage rates and the ongoing pandemic led to a flood of buyers in a market with relatively few homes for sale. This caused prices to rise by double digits throughout the Puget Sound area. Expect the pace of price growth to slow significantly in the coming year due to rising mortgage rates and affordability constraints.

The Puget Sound region is in dire need of more housing units which would function to slow price growth of the area's existing housing. However, costs continue to limit building activity, and that is unlikely to change significantly this year." Builders in Kitsap County are putting up new communities of single family homes and condominiums as fast as they can. Buyers are looking for relief in 2022, hoping inventory will become available. For now, available inventory is described as "drastically low." Buyer pressure is bidding up values, and there is an inordinate amount of institutional cash buyers in our market.

Sellers are frustrated trying to find replacement properties. More contingent offers are being accepted, allowing sellers some breathing room to select their next home and sell their existing home. This trend, coupled with new lending strategies, allow sellers to address the market as though they are cash buyers with conventional 20% down programs. The current market as "truly historical," noting 2021 was one of the best years on record for pending sales. The week of snow and ice that hit Puget Sound in late December delayed the big kickoff to the 2022 housing market by about a week. This held back buyers who have been waiting patiently for each new listing to hit the market. Fresh on the heels of the holiday season and snowy weather, the local market will see continued strong buyer demand, multiple offers, and premium pricing. This year is poised to be another great year in residential real estate. We will experience strong demand and very active home sales in 2022 and maybe a slight dip in price increases. It will be similar to last year, with both opportunities and challenges. The buying and selling process will not become any easier.

Once again we start the real estate dance where buyers are chasing sellers. Sellers are chasing their replacement home, and brokers are chasing those elusive listings. Expect interest rates to climb. Prices will also rise, albeit not as quickly as during 2021. Single family home prices will rise by "high single digits" in King County, and by more than 10% in Snohomish and Pierce counties.

Know the Top 5 Things You Need To Ask For When Getting Mortgage Rates.

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates.

For more Real Estate News and Tips, please tune in to our Facebook Live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com